hk-salary-tax-guide-cn

Introduction

- A concise explanation of the core concepts of Salaries Tax calculation in Hong Kong (such as allowances vs deductions), key considerations (e.g., two options for saving taxes on rental expenses), optimal tax rate conclusions, and how the tax year is divided in Hong Kong.

Core Concepts

- Income: The sum of all pre-tax employment income, including basic salary and bonuses.

- __Allowance__: The portion of income that is not taxable.

- For example, with an income of 12k, an allowance of 2k, and a tax rate of 1%, the tax payable would be 80.

- __Deduction__: If certain qualifying expenses are incurred during the tax year, the non-taxable portion of income can be increased.

- Effectively, this means paying for these expenses with pre-tax income. For instance, with an income of 11k and 3k of qualifying expenses for deductions, at a tax rate of 1%, the tax payable would be 70.

- The difference from allowances is that actual expenses must be incurred.

- IRD: Hong Kong's Inland Revenue Department.

16/16/17%? Progressive vs Standard Tax Rate

- In a conversation, A said the tax rate in Hong Kong is 16%, B thought it was always 17%, and they realized neither fully understood that Hong Kong offers two tax rate options (choose the one resulting in less tax).

- The first is called __Progressive Rate__, where the first 5 increments of 50k income are taxed at 2%, 6%, 10%, 14%, and any part over 200k at a uniform 17%. Using the progressive rate allows the standard allowances and deductions.

- Reference tax table

- The second is known as the Standard Rate, which I prefer to call flat rate, taxing the total income at a uniform 16%, but only allowing for deductions, without the standard allowances.

- Which to choose?

- Conclusion: For annual salaries below 4 million, the progressive rate is more favorable; above that, it's best to calculate both and choose the lower (since individual deductions and tax deductions for rent or mortgage vary).

- Note: The Hong Kong government's 24/25 budget proposal suggests raising the flat rate to 16% for parts exceeding 5 million, but this does not affect the above conclusion.

- Intuitive derivation (just compare higher income scenarios)

- For the first 201k of income, progressive taxation pays 16k, flat rate pays 30k: a savings of 14k with the progressive rate.

- The progressive rate (assuming a family of two) enjoys an additional 265k allowance, saving approximately 45k in taxes at 17% of 264k.

- For every million in income over 201+264k, the progressive rate pays an additional 20k in taxes.

- Thus, the 61k saved in taxes with the progressive rate is "paid back" after reaching an income of 3 million.

- Using the official calculator:

- The government provides one, link

Saving on Taxes Through Renting Is Not Limited to One Scheme

- The government's tax rate table and online calculator both explicitly mention a maximum HK$ 100k deduction for rent, which most people are aware of, but this 100k is often not sufficient for many individuals and most families. There's another tax-saving scheme for renters—housing reimbursement, which usually results in more tax savings when the rent-to-income ratio is relatively high. However, the IRD's explanation is somewhat convoluted; below, I compare the two schemes.

Housing Rent Deduction

- Example: An individual with a monthly salary of 31k, monthly rent of 15k, annual income of 360k, and rent of 180k.

- Calculated with the progressive rate and ignoring allowances, after deducting 101k for rent, the taxable income is 260k, with a tax payable of 26.2k

Housing Reimbursement Provided by Employer

- Do not interpret the Chinese term literally as "employer providing housing to the employee"; the official explanation states it also applies to employees renting on their own (see this link), as long as it is declared to the IRD.

- The calculation method (for annual rent over 101k) deducts the entire rent from income, then multiplies this number by 110%, the additional 10% being the IRD's deemed "rental value" subject to tax.

- Using the example above:

- (ref)

- If calculated using the previous deduction method, the pre-deduction income is 361k, and the post-deduction income is 260k. However, using the Housing reimbursement method, the taxable income becomes (Income - Rent) 110% = (360k - 180k) 1.1 = 198k, significantly lower than 260k, with a tax payable of around 16k, saving 10k.

- The declaration method is to have the company split the monthly salary into two parts, one exactly equal to your monthly rent, and the other the remainder. It needs to be declared in advance every year, and if it turns out that using deduction is more favorable after calculating taxes during the tax season, reimbursement can be abandoned.

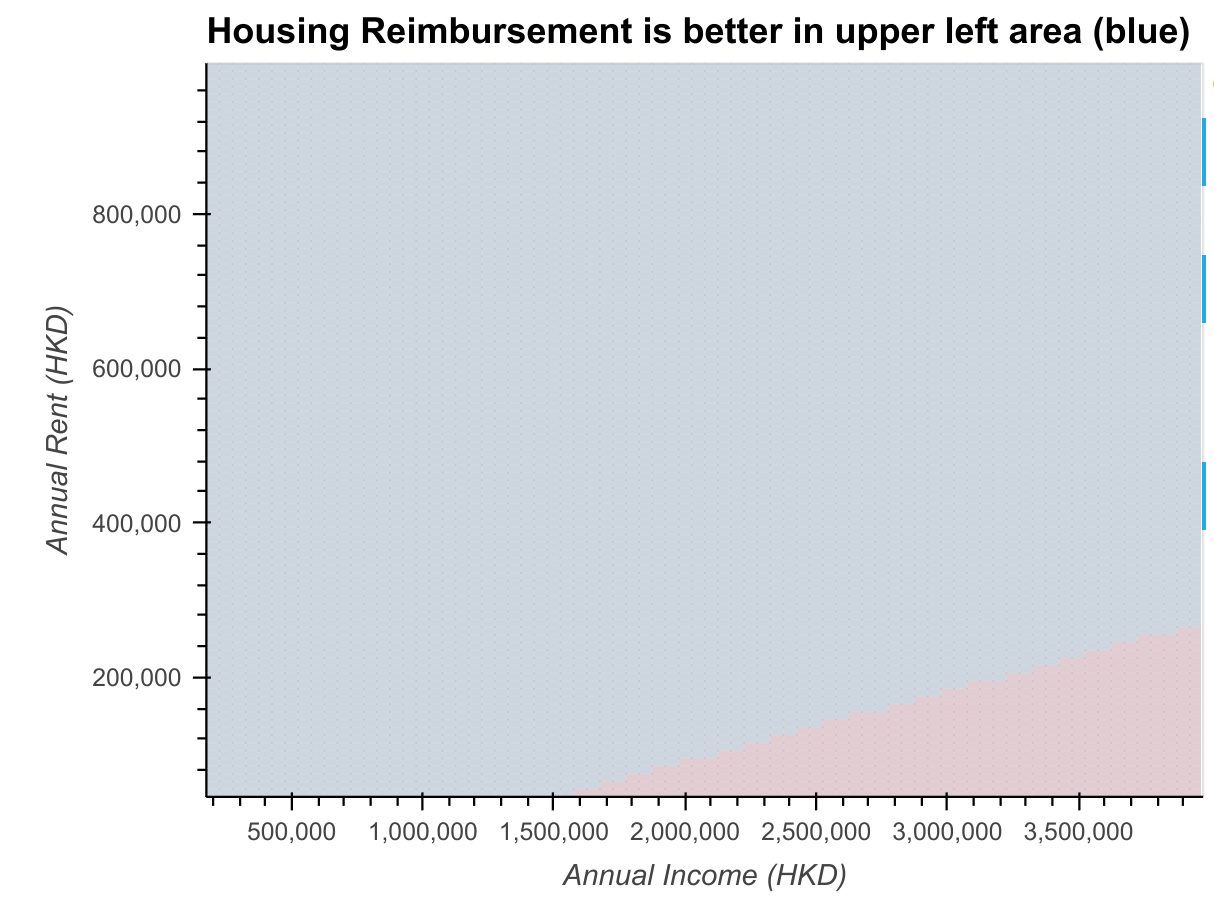

Which is better under various income and rent scenarios?

- Conclusion:

- If your annual salary is and your rent is , then when \, choosing housing reimbursement is better

- For example, with an annual income of 810k and annual rent of 300k, the left side of the inequality is 180k, and the right side is 330k

- As shown in the diagram below, the blue area in the upper left is where reimbursement is more cost-effective

- The intuitive understanding is that the higher the rent-to-income ratio, the more tax is saved with reimbursement. Only those with very high incomes and very low rent (e.g., an annual salary of 5.01 million with a monthly rent of 3k) would not benefit from this tax-saving scheme.

- Since housing reimbursement requires enrollment and can be abandoned without penalty, it's advisable to enroll first!

- Derivation:

- Continuing with the symbols for salary and for rent, the income using the first method (deduction) is , and using the latter method (reimbursement), the income is

Tax Year and Tax Payment Timing

- Tax Year is from May of the current year to March of the following year, e.g., the 24/25 tax year refers to April 1, 2024, to March 31, 2025.

- Employers and employees fill out tax forms from May to May (comparable to the W2 in the US). Employees can submit online (requires setting up an eTax account). Then wait for IRD's review.

- Tax payment timing (for the 2025/25 tax year as an example):

- File taxes in April-May 2026

- Pay the full amount of the tax due for the 2024/25 tax year in January 2027 (by this time, the 2024/25 tax year is long past, and the 2025/26 tax year has just ended three quarters), and also pay 3/4 of the estimated tax due for the 2025/26 tax year.

- In April 2027 (by which time the 2025/26 tax year has just ended), file taxes and pay the remaining 25%, with adjustments made for over or underpayment.

- Considerations:

- Employers do not withhold tax (also called tax withhold. This practice is consistent with Europe and America, and different from Mainland China), it's necessary to prepare the money oneself. If liquidity is an issue, banks offer special low-interest loans for tax payments.

- If the tax payment deadline is missed, an immediate penalty of 6% of the tax due is imposed.

- New taxpayers: Employers need to notify the IRD within three months of employment.

Profits Tax, Property Tax: Beyond Salaries Tax in Hong Kong's Tax System

- See Google "Deloitte - Hong Kong Taxation and Investment Guide 2024"

1 page links here

hk-salary-tax-guide

English version: hk-salary-tax-guide-cn